Note: For easier readability, please access Google Doc version here.

The third COVID-19 emergency legislation – or Coronavirus Aid, Relief, and Economic Security (CARES) Act – that was enacted into law Friday March 27, 2020 is widely known for providing direct cash assistance and pandemic unemployment insurance to some individuals. This document is intended to clarify the content of the CARES Act as it relates to our community.

- Main Provisions

| Relief Provision | Description | Details | Who is eligible? | Who is not eligible? | How do I receive this? |

| Direct Cash Assistance

|

$1,200 one-time payment per adult (up to $75,000 in annual income for individuals and $150,000 for joint filers) and $500 per child (under 17) | Rebate amount reduced by $5 for each $100 a taxpayer’s income exceeds the income threshold – complete phaseout at $99,000 for individuals and $198,000 for joint filers

Credits: Beyond Financial Includes those with no income If I have a past due debt to a federal or state agency, or owe back taxes, will my rebate be reduced? No, the bill turns off nearly all administrative offsets that ordinarily may reduce tax refunds for individuals who have past tax debts, or who are behind on other payments to federal or state governments, including student loan payments. The only administrative offset that will be enforced applies to those who have past due child support payments that the states have reported to the Treasury Department. |

Families where everyone has a Social Security Number (SSN) (Exception for military families if at least one spouse has a valid SSN.) | Families where one person does not have a SSN –

A child with a SSN would not be able to obtain the cash assistance if a parent is undocumented. If a married couple files together and one person is undocumented, both are disqualified from assistance. |

For the vast majority of Americans, no action on their part will be required to receive a rebate check since the IRS will use a taxpayer’s 2019 tax return if filed or their 2018 return if they haven’t filed their 2019 return. The best way to ensure you receive a recovery rebate is to file a 2019 tax return if you have not already done so. This could be accomplished for free online from home using the IRS Free file program (https://www.irs.gov/filing/free-file-do-your-federal-taxes-for-free). |

| Pandemic Unemployment Compensation (PUC) | $600/week in addition to other unemployment insurance benefits (totaling 100% wage replacement) for 4 months

|

This is a flat amount to those on UI, including those who are receiving a partial unemployment benefit check. This also goes to those receiving the new Pandemic Unemployment Assistance program described below.

PUC may be paid either with the regular UI payment or at a separate time, but it must be paid on a weekly basis. PUC is not income for purposes of eligibility for either Medicaid or CHIP. |

Everyone who is work authorized at time of filing and who was work authorized for base period they want to claim the Unemployment Insurance (including DACA recipients and work visa holders) | Noncitizens who are not work authorized or were not work authorized when they were working.

|

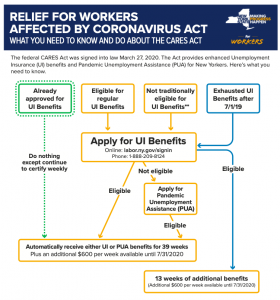

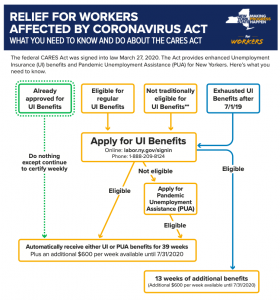

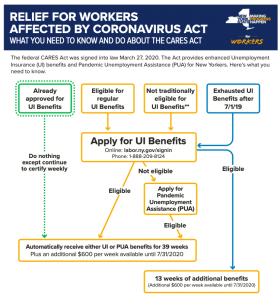

See chart below. |

| Pandemic Emergency Unemployment Compensation (PEUC) | 13 additional weeks of state unemployment benefits through December 31, 2020 | Everyone who is work authorized at time of filing and who was work authorized for base period they want to claim the Unemployment Insurance (including DACA recipients and work visa holders)

To receive PEUC, workers must be actively engaged in searching for work. The bill explicitly provides, however, that “a State shall provide flexibility in meeting such [work search] requirements in case of individuals unable to search for work because of COVID-19, including because of illness, quarantine, or movement restriction.” |

Noncitizens who are not work authorized or were not work authorized when they were working.

|

See chart below. | |

| Pandemic Unemployment Assistance (PUA) | Up to 39 weeks of emergency unemployment assistance to workers who are left out of regular state UI or who have exhausted their state UI benefits (including any Extended Benefits that might become available in the future). Program expires December 31, 2020. | In most states “gig” workers should qualify for regular UI because of the broad definitions of employment in so many state UI laws and should be encouraged and supported in applying for regular UI.

Eligible for retroactive benefits. |

Self-employed workers, including independent contractors, freelancers, workers seeking part-time work, and workers who do not have a long-enough work history to qualify for state UI benefits. Must be work authorized currently and for period they want to claim Unemployment Assistance.

Applicants will need to provide self-certification that they are (1) partially or fully unemployed, OR (2) unable and unavailable to work because of one of the following circumstances:

|

Workers who are eligible for state UI.

Noncitizens who are not work authorized or were not work authorized when they were working. Workers who can either telework with pay or are receiving paid sick days or paid leave. |

See chart below. Apply for PUA through your state. To find out how to apply for unemployment in your state visit:

https://www.careeronestop.org/WorkerReEmployment/UnemploymentBenefits/unemployment-benefits.aspx |

| COVID-19 free testing and treatment | COVID-19 free testing and treatment | This provision is from the 2nd emergency legislation package: Families First Coronavirus Response Act. | Individuals who qualify for federal Medicaid | Individuals who do not qualify for federal Medicaid- individuals who only qualify for state Medicaid (i.e. DACAmented individuals, most lawful permanent residents during their first five years in that status, survivors of crime granted U visas, people from certain Pacific Island nations, people with TPS, undocumented individuals) | Find a Health Center (HRSA)

|

| Paycheck Protection Program | Forgivable loans for 8 weeks of payroll (up to $10 million) to employers (including nonprofits) with less than 500 employees, self-employed individuals, and gig workers

The Paycheck Protection Program (PPP) loan guarantees the business 250% times 1 month of payroll up to $10 million. Sample Application: www.sba.gov/document/sba-form–paycheck-protection-program-ppp-sample-application-form

|

During the 8-week period following the PPP loan origination date, funds must be used to pay for:

The amount of loan forgiveness will be reduced if there was a reduction in number of employers or reduction of more than 25% in wages paid to employees.

This means the business should eliminate the reduction by re-hiring previously laid-off employees or restoring employees’ previous compensation levels.

|

You are a small business, 501c3 nonprofit organization, a 501c9 veterans organization, or tribal business that has 500 employees or fewer, including Full-Time, Part-Time, and Other

(such as seasonal employees and independent contractors) per physical location – OR that meets the SBA size standard for small business – OR you are a sole proprietorship, independent contractor, or self-employed Business had to be in operation as of February 15, 2020 Business paid salary and payroll taxes and paid independent contractors (eg form 1099-MISC) |

See previous column. | Find a Small Business Administration (SBA) certified bank near you. Your business bank

may already be SBA certified. Call them and set up an appointment to review your case – they will need to verify you are a legitimate business. Provide proofs of payroll expenses (monthly average of payroll costs going back 1 year) and IRS/nonprofit status. Find a SBA certified bank by typing your zip code here: https://www.sba.gov/local-assistance/find/ Ethnic banks that have SBA loans include: Hanmi Bank, Bank of Hope, Woori America, HSBC Try our payroll calculator and see how much you might qualify for (please note that this tool will not guarantee the amount you will receive – that will be reviewed by the lender)! PPP calculation

Information you MAY have to bring (This will be dependent on your bank):

|

|

Tax benefits |

Refundable payroll tax credit for 50% of wages paid to employees for employers that suspend operations or see over 50% drop in receipts

Allows employers to delay paying the employer share of payroll taxes Requires that the deferred employment tax be paid over the following two years (by December 31, 2022)

Allows businesses (including pass-throughs) to offset up to 100% of taxable income with “carry back” losses

Acceleration of corporate Alternative Minimum Tax credits

Increased deductions for business interest

Faster write-offs for business investments

Excise tax on distilled spirits waived for use in hand sanitizer

Above-the-line deduction for charitable contributions up to $300 and increase in limits on individual and corporate deductions for charitable contributions

Waives tax penalty for early withdrawal of retirement funds |

Eligible employers can take advantage of a refundable payroll tax credit for 50 percent of wages paid by employers to employees during the COVID-19 crisis, provided they did not receive SBA payroll support loans.

The credit is provided for the first $10,000 of compensation, including health benefits, paid to an eligible employee |

The credit is generally available to employers whose operations were affected by COVID-19 and is based on qualified wages paid to the employee:

For employers with greater than 100 full-time employees, qualified wages are wages paid to employees when they are not providing services due to the COVID-19-related circumstances described above. For eligible employers with 100 or fewer full-time employees, all employee wages qualify for the credit, whether the employer is open for business or subject to a shut-down order. |

Eligible Employers will report their total qualified wages and the related credits for each calendar quarter on their federal employment tax returns, usually Form 941, Employer’s Quarterly Federal Tax Return. Form 941 is used to report income and social security and Medicare taxes withheld by the employer from employee wages, as well as the employer’s portion of social security and Medicare tax.

In anticipation of receiving the credits, Eligible Employers can fund qualified wages by accessing federal employment taxes, including withheld taxes, that are required to be deposited with the IRS or by requesting an advance of the credit from the IRS. |

Credits for Legislative Analysis: Progressive Action Caucus Fund, National Employment Law Project

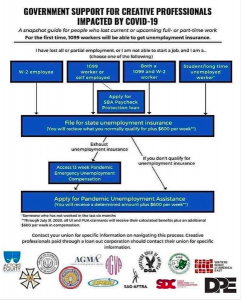

Note: This graphic also applies to workers outside of the creative industry.

For those who are interested in the broader provisions of the whole bill, here are the pieces we as NAKASEC support and condemn:

Broad Bill Provisions We Condemn

- $500 billion slush fund that Secretary of Treasury Steve Mnunchin has discretion to funnel to corporations with few or easily waived restrictions

- Expansion of discriminatory and unjust federal restrictions that block individuals from accessing abortion care

- Lack of addressing Puerto Rico’s particular needs; While the Senate bill has included Puerto Rico and other territories in most of its provisions, Puerto Rico’s particular needs — increasing SNAP benefits, leveling tax credits, and ensuring that cash aid will reach the most vulnerable populations—have not been met in this package.

- Failure to increase SNAP benefits, despite lessons from history – the temporary SNAP benefit increase in the Great Recession was key to preventing increases in poverty.

Broad Bill Provisions We Support

- $350 million for “Migration and Refugee Assistance” under the Department of State.

- Avoiding specific bailouts for the fossil fuel industry.

- No new funds for Immigration and Customs Enforcement or Customs and Border Protection. Transfer and reprogramming restrictions attached to Department of Homeland Security operational money. The bill prevents Department of Defense funds from being diverted for border wall construction on the southern border.

We are fighting for a fourth relief package to

- Provide free COVID-19 relief, testing and care for all.

- Suspend practices and policies that further endanger immigrant communities, like ICE enforcement and the public charge rule

- Expand unemployment insurance and cash payments to all people, including self-employed individuals and immigrants who pay taxes using an ITIN (Individual Tax Identification Number); and,

- Automatically extend protection for DACA recipients and TPS holders to ensure that our frontline workers in this pandemic have stability and the ability to stay safe, in light of the impending termination of both programs.

Resources

Three_Step_Process_SBA_Disaster_Loans (1) (This is different from the Paycheck Protection Program.)